va home equity loan texas

Todays national VA mortgage rate trends. Conventional FHA VA USDA Jumbo Refinance Available in all states 620 See rates More Info.

![]()

Cash Out Refinance Vs Home Equity Loan Rocket Mortgage

Learn more about using a home equity loan for a second home.

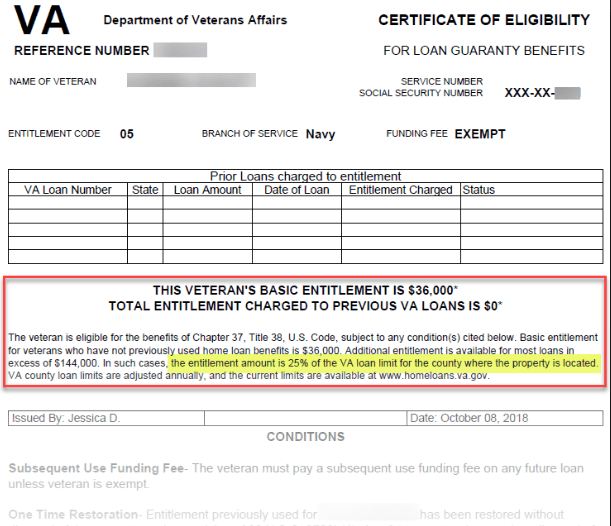

. They might be relatively less than. You can use it as many times as you want. However many lenders have their own minimum credit requirements of 620 or more which makes it difficult for some veterans to qualify for a VA loan.

Keep in mind that for a VA-backed home loan youll also need to meet your lenders credit and income loan requirements to receive financing. By default refinance rates are displayed. YES One-Time Close - True Prefabricated Modular Homes.

Any VA home loan that you are taking is definitely going to come with closing costs. Talk to a lender. First unlike a VA Streamline refinance homeowners cant simply roll their closing costs on top of their loanBut you can finance your closing costs into your new loan as long as you can still meet a lenders requirements for loan-to-value ratio.

Veterans United stands out. Navy Federal Credit Union home equity review. 15 2004 to establish home loan eligibility.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Filters at the top of the rate table allow you to adjust your mortgage settings. 210-531-USAA 8722 800-531-USAA 8722 Mailing Address.

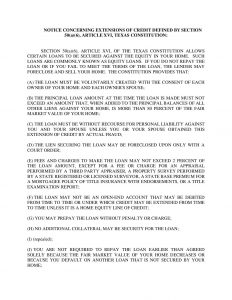

There are special laws you need to know if you plan on getting a HELOC or home equity loan in Texas. Borrow money as you need it up to your line of credit limit. Max Allowable Base.

On Sunday September 4th 2022 the average APR on a 30-year fixed-rate mortgage fell 7 basis points to 5770The average APR on a 15-year fixed-rate mortgage fell 3 basis points to 5045 and. Home by Geneva - Home Design Lifestyle Geneva Gives Geneva Financial offers Conventional FHA VA USDA Refinance Reverse Jumbo and Condo Financing as well as Down Payment Assistance Programs First-Time Homebuyer Programs Physician Loans and Hero Loans for First Responders Police Firefighters Nurses and Teachers. You need money over time.

Use your benefit again and again. When you need to fund a big expense a home equity loan can help you tap into Read More. Viewed the same as a stick build traditional homes by lenders around the country this property style could allow you to save money decrease build time and get a great home at a cheaper rate than Manufactured Homes Eligible on our FHA VA Construction Loan ProgramPrefab Modular Homes are usually built.

As a homeowner youll build equity in your home with each mortgage payment. You can adjust your loan settings to change away from a 30-year 250000 fixed-rate loan on a 312500 home located in Boydton to a purchase loan a different term length a different location or a different loan amount. You need a specific amount right now.

Heres how to buy a mobile home with a zero down VA home loan. There are more than 5000 branch locations in the US in addition to its. Additional restrictions apply to Texas home equity loans.

These types of loans are backed by the VA and are used by veterans to help them secure housing. The requirements for VA loans are more flexible than any other loan program available. Borrow up to 90 of your homes equity and receive all the money at signing.

Citation neededHome equity loans are often used to finance major expenses such as home repairs medical bills or college. VA Home Loan Benefits. VA must deny applications from.

Once such type is the VA loan. Using a VA loan saves you money upfront and tremendously increases your buying power. This allows veterans to take advantage of older homes that may not initially be liveable while using their earned VA loan benefit.

Yes you can use a home equity loan to buy another house. For today Sunday September 04 2022 the national average 30-year VA mortgage APR is 5420 up compared to last weeks of 5120. Using a home equity loan also called a second mortgage to purchase another home can eliminate or reduce a homeowners out-of-pocket expenses.

If you want to use a VA home. VA loans are also available for credit scores as low as 500. Get 35000-300000 from your homes equity with a low fixed-rate home equity loan from Discover with zero origination fee.

Home Equity Products Home Equity Loan HELOC Interest-Only HELOC. Home Equity Loan Rates Requirements 2022. When looking to sell your home there are a lot of different loans options a buyer might bring to the table.

However taking equity out of your home to buy another house comes with risks. Find out how to request a Certificate of Eligibility COE to show your lender that you qualify based on your service history and duty status. A home equity loan is a type of loan in which the borrowers use the equity of their home as collateralThe loan amount is determined by the value of the property and the value of the property is determined by an appraiser from the lending institution.

Those looking to tap into their homes equity should be aware of a few important considerations. In 2018 the VA updated its guidelines to make it possible for veterans to purchase or refinance a home in need of alteration andor repair with a VA renovation loan. The advertised rates are based on certain assumptions and loan scenarios.

If you get a home equity loan from USAA the loan amount will be paid back with monthly interest over a fixed loan term. How to get a VA Home improvement loan. Your VA home loan benefit is not one-and-done.

Grove Mortgage Home Loans in San Antonio Texas. You need money over time. In the US the Federal government created several programs or government sponsored.

2021 VA Loan Limit VA Entitlement Purchase Calculator to estimate a Veterans remaining VA loan eligibility when a veteran already has a VA Loan. While a great program for the buyer they can initially be a bit off-putting for sellers. With a VA loan this buyer could afford a home worth 30000 more with the same monthly payment simply be eliminating PMI.

Celebrating 18 years of Mortgages in Texas. VA Loan Requirements with Bad Credit. If you already own one home with a VA loan it is possible to purchase another home using a second VA loan says Chuck Walden senior branch manager in the Gwinnett County office of Silverton.

Other rates and terms available. Bank of America is a big bank lender that offers mortgage and refinance loan products along with full banking services. Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan.

Lower the mortgage rate pay off a non-VA loan or obtain cash from your mobile homes equity through a cash-out refinance. 16 2003 and on or after attaining age 57 must have applied no later than Dec. San Antonio Texas 78288.

Required Down Payment.

Home Equity Loans Home Loans U S Bank

What Is A Home Equity Loan Money

Home Equity Loans Pros And Cons Minimums And How To Qualify

Texas Home Equity 12 Day Notice For Home Equity Loans Black Mann Graham L L P

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

9 Best Home Equity Loans Of 2022 Money

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Are There Va Home Equity Loans A Look At Options Lendingtree

Va Loan For A Second Home How It Works Lendingtree

Home Equity Loans Pros And Cons Minimums And How To Qualify

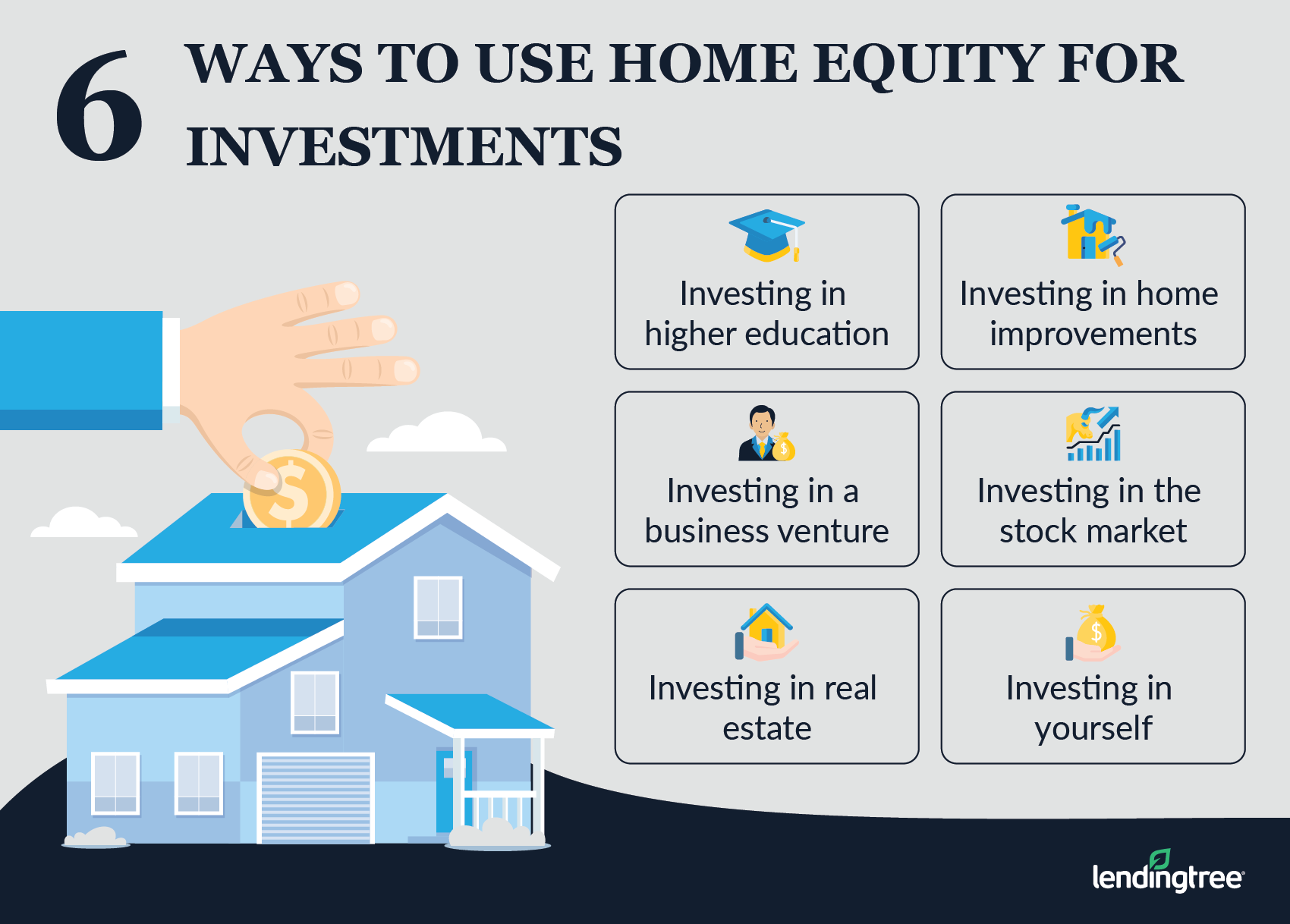

Can You Use Home Equity To Invest Lendingtree

Best Home Equity Loan Lenders Of September 2022 Forbes Advisor

Texas Home Equity Cash Out Refinance A6 Mortgagemark Com

Home Equity Line Of Credit Qualification Calculator

Home Equity Loans Calculate Your Heloc Or Home Equity Loan Payments Using Current Rates

Home Equity Loan Vs Mortgage Key Differences Smartasset

Va Loan Funding Fee Closing Cost Calculator

How To Get A Home Equity Loan With Bad Credit Forbes Advisor